UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

Crane Co.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

CRANE CO.

100 FIRST STAMFORD PLACE

STAMFORD, CONNECTICUT 06902

Dear Fellow Stockholders:

Crane Co. cordially invites you to attend the Annual Meeting of Stockholders of Crane Co., which will be held at 10:00 a.m., Eastern Daylight Time, on Monday, April 23, 2018 in the26, 2021, at 100 First Stamford Place, Ground Floor Conference Room, at 200 First Stamford Place, Stamford, Connecticut.

The Notice of Annual Meeting and Proxy Statement on the following pages describe the matters to be presented at the meeting. Management will report on current operations, and there will be an opportunity to ask questions regarding Crane Co. and its activities. Our 2017 Annual Report to Stockholders accompanies this Proxy Statement.

It is important that your shares be represented at the meeting, regardless of the size of your holdings. If you are unable to attend in person, I urge you to participate by voting your shares by proxy. You may do so by filling out and returning the enclosed proxy card, or by using the internet address or the toll-free telephone number onset forth in this Proxy Statement, or by requesting a printed copy of the proxy card.materials and completing and returning by mail the proxy card you receive in response to your request.

Sincerely,

R.S. Evans

James L.L. Tullis

Chairman of the Board

March 15, 201812, 2021

| This Proxy Statement | |||

| and the 2020 Annual Report to Stockholders are available at www.craneco.com/ar | |||

This Proxy Statementand the 2017 Annual Report to Stockholdersare available at www.craneco.com/ar

2018 Proxy Statement 1

| 2021 Proxy Statement | 1 |

This page intentionally left blank.

NoticeTable of Annual Meetingof Stockholders

ContentsApril 23, 2018

| NOTICE OF ANNUAL MEETING OF STOCKHOLDERS | ||

| APRIL 26, 2021 | ||

To the Stockholders of Crane Co.:

THE 2018

The 2021 ANNUAL MEETING OF STOCKHOLDERS OF CRANE CO. will be held for the following purposes:

| WHEN: |

| April 26, 2021 Monday 10:00 a.m. Eastern Daylight Time | |

| WHERE: |

| 100 First Stamford Place Ground Floor Conference Rm Stamford, Connecticut | |

| HOW TO VOTE: | |

| By Phone |

| 800-652-VOTE (8683) in the United States, United States territories, and Canada | |

| By Mail |

| If you have requested a paper copy of the proxy materials, complete, sign, and return the proxy card. | |

| By Internet |

| www.envisionreports.com/cr | |

| In Person |

| Stockholders at the close of business on February 26, 2021, are entitled to vote at the meeting in person. | |

| By Scanning |

| You can vote your shares online by scanning the QR code on your proxy card. | |

| Board | ||

| Proposal | Recommendation | |

| Item 1 | To elect | FOR each director ► Page 11 |

| ||

| ||

| ||

|

In order to assure a quorum at the meeting, it is important that stockholders who do not expect to attend the meeting in person fill in, sign, date and return the enclosed proxy card in the accompanying envelope, or use the internet address or the toll-free telephone number on the enclosed proxy card.

The Board of Directors has fixed the close of business on February 28, 2018 as the record date for the meeting. Stockholders at that date and time are entitled to notice of and to vote at the meeting or any postponement or adjournment of the meeting. A complete list of stockholders as of the record date will be open to the examination of any stockholder during regular business hours at the offices of Crane Co., 100 First Stamford Place, Stamford, Connecticut 06902, for ten days before the meeting, as well as at the meeting.

By Order of the Board of Directors,

Anthony M. D’IorioSecretaryMarch 15, 2018

IF YOU EXPECT TO ATTEND THE MEETING IN PERSON, PLEASE CONTACT THE CORPORATE SECRETARY,CRANE CO., 100 FIRST STAMFORD PLACE, STAMFORD, CONNECTICUT 06902,OR BY EMAIL TO ADIORIO@CRANECO.COM.

2018 Proxy Statement 3

Proxy Summary

|

| |||

|

|  |

| |

| ||||

|

|  |

| |

|

|  |

| |

This Proxy Statement and enclosed form of proxy are first being sent to stockholders on or about March 15, 2018.

Voting Matters

| Item 2 | To consider and vote on a proposal to ratify the selection of Deloitte & Touche LLP as independent auditors for Crane Co. for | FOR | ► Page 31 | |||

| Item 3 | To consider and vote on a proposal to approve, by a non-binding advisory vote, the compensation paid by the Company to certain executive officers | FOR | ► Page 34 | |||

| Item 4 | To consider and vote on a proposal to approve the 2018 Amended & Restated Stock Incentive Plan | FOR | ► Page 73 |

Director NomineesIn addition, any other business properly presented may be acted upon at the meeting.

In order to assure a quorum at the 2021 Annual General Meeting of Stockholders of Crane Co. (the “Annual Meeting”), it is important that stockholders who do not expect to attend in person use the internet address or the toll-free telephone number listed in this Proxy Statement to vote. If you have requested paper copies of the proxy materials, you can vote by completing and Continuingreturning the proxy card enclosed in those materials.

Any stockholder of Crane Co., any past or present associate, and other invitees may attend the Annual Meeting. Due to the ongoing COVID-19 pandemic, attendees will be required to comply with various health and safety protocols including wearing a cloth face covering and social distancing. We continue to monitor COVID-19 developments and if we determine that alternative Annual Meeting arrangements are advisable or required, then we will announce any changes in advance in a press release available on our website at www.craneco.com and filed with the Securities and Exchange Commission.

The Board of Directors has fixed the close of business on February 26, 2021, as the record date for the meeting. Stockholders at that date and time are entitled to notice of and to vote at the Annual Meeting or any postponement or adjournment of the Annual Meeting. Each share is entitled to one vote. This Notice of Annual General Meeting of Stockholders and related Proxy Statement are first being distributed or made available to stockholders on or about March 12, 2021.

We previously mailed a Notice of Internet Availability of Proxy Materials to all Crane Co. stockholders as of the record date. The notice advised such stockholders that they could view the Proxy Statement and Annual Report online at www.envisionreports.com/cr, or request in writing a paper or e-mail copy of the proxy materials at no cost. The Company is making its proxy materials available electronically as the primary means of furnishing proxy materials to stockholders in order to reduce the environmental impact and cost of our proxy solicitation.

A complete list of stockholders as of the record date will be open to examination by any stockholder during regular business hours at the offices of Crane Co., 100 First Stamford Place, Stamford, Connecticut 06902, for 10 days before the Annual Meeting, as well as at the Annual Meeting.

By Order of the Board of Directors,

Anthony M. D’Iorio

Secretary

March 12, 2021

If you expect to attend the annual meeting in person, please contact the Corporate Secretary, Crane Co., 100 First Stamford Place, Stamford, Connecticut 06902, or by email to Director Nomineescorpsec@craneco.com.

| 2021 Proxy Statement |

Director Nominees

| Director | Crane Co. Committees | ||||||

| Name and Profession | Age | Since | AC | NGC | EC | MOCC | |

| Martin R. Benante Retired Chairman of the Board and Chief Executive Officer, Curtiss-Wright Corporation | 68 | 2015 | ||||

| Donald G. Cook General, United States Air Force (Retired) | 74 | 2005 | ||||

| Michael Dinkins Retired Executive Vice President and Chief Financial Officer, Integer Holdings Corporation | 66 | 2019 | ||||

| Ronald C. Lindsay Retired Chief Operating Officer, Eastman Chemical Company | 62 | 2013 | ||||

| Ellen McClain Chief Financial Officer, Year Up | 56 | 2013 | ||||

| Charles G. McClure, Jr. Managing Partner, Michigan Capital Advisors | 67 | 2017 | ||||

| Max H. Mitchell President and Chief Executive Officer of Crane Co. | 57 | 2014 | ||||

| Jennifer M. Pollino Executive Coach and Consultant, JMPollino LLC | 56 | 2013 | ||||

| John S. Stroup Executive Chairman, Belden, Inc. | 54 | 2020 | ||||

| James L. L. Tullis Chairman, Tullis Health Investors, Inc. | 73 | 1998 | ||||

| Audit Committee | |||||||||||||

| Nominating and Governance Committee | Chair | Member | |||||||||||

| Executive Committee | |||||||||||||

| Management Organization and Compensation Committee | |||||||||||||

4 Crane Co.

| 4 | Crane Co. |

Proxy Summary

Continuing Directors

Board Snapshot

|  |  |

Corporate Governance Highlights

Recent Governance Enhancements

As stated in our Corporate Governance Guidelines, the Board has a leadership responsibilityis responsible for helping to help create a culture of high ethical standards.standards and is committed to continually improving its corporate governance process, practices and procedures. Accordingly, the Board has adopted the following best practices in corporate governance.

Recent Governance Enhancements

Annual election of directors:Following the recommendation of the Board, stockholders approved at our 2017 annual meeting of stockholders amendments to declassify the Board of Directors. Beginning with the 2017 annual meeting, directors are elected to serve one year terms expiring at the following annual meeting.See page 10 for additional information, including the effect on continuing directors serving the remainder of their terms.

Board renewal (sixand composition (eight new directors in the last five years)eight years and increased board size in 2020):The Board, specifically through the Nominating and Governance Committee, continually evaluates the skills, expertise, integrity, diversity, and other qualities believed to enhance the Board’s ability to manage and direct in an effective manner, the affairs and business of the Company. Since 2013, the Board has added sixeight new directors.directors and, in 2020, increased its size from nine to ten directors, to accomplish these goals. See additional information beginning on page 1213 about our Board nominees and continuing directors.nominees.

New disclosures:Annual election of directors: For this 2018 Proxy Statement, weFollowing the recommendation of the Board, stockholders approved amendments to declassify the Board of Directors at our 2017 annual meeting of stockholders. Since the 2017 annual meeting, all directors have undertaken a thorough reviewbeen elected to serve one-year terms expiring at the following annual meeting. As of the 2019 Annual Meeting, our transition to annual election of all of our proxy disclosures withdirectors was complete. We believe that directors should be re-elected annually, providing more accountability than boards that are staggered and enhancing the intentability to providepromptly evaluate a more reader-friendly document focused on information most important to our stockholders. In this regard, we have added new content on certain governance practices, including Board oversight of management succession planning, stockholder engagement, our Board evaluation process, director education and CEO pay ratio.See pages 21, 24, 25, and 64 for additional information.board’s performance.

2018 Proxy Statement 5

Proxy Summary

| Ongoing Board Governance Practices | |||

• Separate Chairman and CEO roles | • 100% independent Board committees • Regular executive sessions of non-management directors • Annual Board and committee performance self-evaluations • 100% Board and committee attendance in 2020 • Offer of resignation upon significant change in primary job responsibilities • Directors are elected annually • Majority voting and director resignation policy for directors in uncontested elections | ||

• Stringent conflict of interest policies | |||

• Directors subject to | |||

• Director retirement policy | |||

• Strict over-boarding policy for directors • Diverse Board with the appropriate mix of skills, experience and perspective • Comprehensive director nomination and Board refreshment process • Oversight of sustainability and human capital matters impacting our business |

2017

2020 Performance Highlights

In March 2020, the World Health Organization categorized the novel coronavirus (“COVID-19”) as a pandemic. During the remainder of 2020, the COVID-19 pandemic continued to spread throughout the United States and other countries across the world, significantly impacting the health and safety of people around the world and causing wide-spread economic disruptions to the financial markets, the global economy, and to our business.

The COVID-19 pandemic had a substantial impact on demand for most of our businesses and related end markets, and that impact was completely beyond the control of management. The pandemic related demand destruction was so severe that comparison of actual 2020 results to our original 2020 plan and financial targets, as developed in late 2019 and approved by the Board in early 2020, is not meaningful.

| 2021 Proxy Statement | 5 |

Proxy Summary

The COVID-19 pandemic and related uncertainty also posed unique and substantial challenges for our normal forecasting and budgeting methodologies throughout 2020. Those challenges were so significant that most U.S. public industrial companies withdrew financial guidance in the spring of 2020. However, consistent with our desire to be fully transparent with our stockholders, we publicly revised and updated all elements of our typical financial guidance with additional details and granularity on April 27, 2020, concurrent with the release of our first quarter 2020 financial results. Furthermore, we continued to update our views and outlook at each of our successive quarterly earnings calls in July and October. While actual financial results for 2020 fell short of our initial pre-pandemic guidance, they compared favorably to our April 27, 2020 revised guidance.

Strong Operational Performance Under Challenging Circumstances

We are proud of our response to the unprecedented set of circumstances we faced during 2020, particularly related to the actions we took to ensure the safety and well-being of our associates, and where possible, to retain them through the pandemic. Starting in early March, we quickly adopted new safety protocols and procedures worldwide, in most cases more stringent than, and in advance of, government mandates. We also quickly adopted a new Emergency Pandemic Exception Pay (“EPE”) program providing additional paid time off to all Crane associates globally that were directly or indirectly impacted by COVID-19.

From a financial perspective, we believe that we were on-track to meet or exceed our 2020 financial targets before the pandemic hit, consistent with our commentary at our February 27, 2020 annual Investor Day event. While final 2020 financial results were below our original financial targets for the year, we believe that the shortfall was entirely related to the impact of COVID-19, and that our operational performance and execution against long-term strategic objectives were excellent considering the unexpected market related challenges arising from the pandemic.

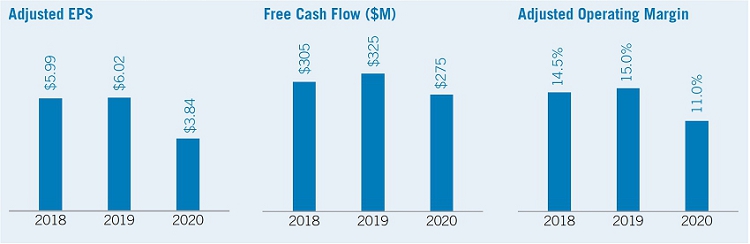

| • | Sales in 2020 were $2,937 million, or 11%, below sales in 2019. The decline in sales was comprised of a 17% decline in core sales partially offset by a 6% benefit from acquisitions and slightly favorable foreign exchange rates. Notably, the core sales decline compared to our pre-pandemic expectations was most severe at two of our highest margin businesses: the commercial aircraft portion of Aerospace & Electronics which was significantly impacted by reduced passenger air travel (core sales 38% below prior year), and at Crane Payment Innovations where our products cater to consumer traffic, for example, at various retail stores, casino gaming and mass transit ticketing locations, among others (core sales 37% below prior year). Despite the sharp market-driven declines, we believe that we gained market share across most of our primary businesses during 2020. |

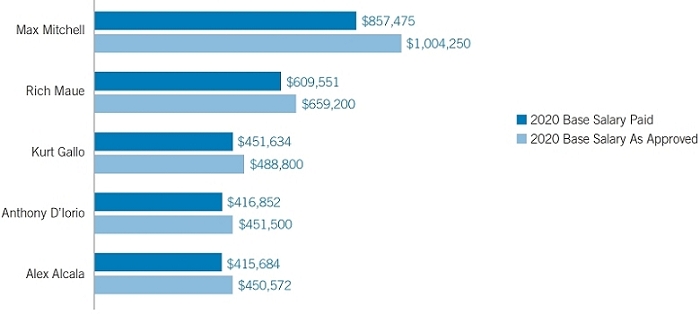

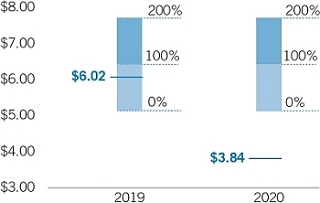

| • | Adjusted operating profit in 2020 declined 35% compared to 2019. Excluding the impact of acquisitions, decremental margins (change in adjusted operating profit divided by change in sales) of 35%, were an impressive result given the magnitude of the sales decline and the highly negative business and product mix, reflecting extremely strong operational execution. Adjusted earnings per share (EPS) in 2020 declined 36% compared to 2019, similar to the decline in adjusted operating profit. These results also reflect the impact of our cost reduction initiatives which delivered approximately $105 million of gross savings in 2020. |

| • | Free cash flow in 2020 declined 15% compared to 2019, a more muted decline than for adjusted operating profit or adjusted EPS, reflecting strong working capital management and controlled capital expenditures. |

| 6 | Crane Co. |

Proxy Summary

See “Non-GAAP Reconciliation” beginning on page 84 for more detail regarding Special Items impacting EPS, free cash flow and operating margins, as well as a reconciliation of the non-GAAP measures used herein.

In addition to operational execution during 2020, we continued to execute on all key strategic growth initiatives to ensure that Crane emerges from the pandemic related downturn stronger than competitors and positioned for long-term stockholder value creation. Notable accomplishments included:

| • | The integration of Cummins-Allison Corp. (acquired in December 2019) and the integration of Instrumentation & Sampling (acquired in January 2020), as well as continued work to identify additional acquisition opportunities. |

| • | We introduced new products and solutions at an accelerating pace in 2020, most notably at Fluid Handling and Payment & Merchandising Technologies. |

| • | We continued to invest in the development of next-generation technologies, most notably at Aerospace & Electronics and Payment & Merchandising Technologies. |

| • | The combination of new product development and advances in our technology capabilities resulted in share gains across our portfolio despite disruptions related to the pandemic. |

| • | We continued to execute on repositioning actions in Fluid Handling initiated at the end of 2019 which involved facility consolidations to better geographically align our manufacturing footprint with customer needs, and to improve our cost position. |

Taken together, we believe all these actions position the Company for years of profitable growth.

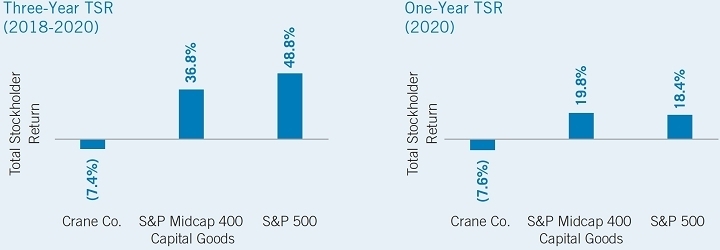

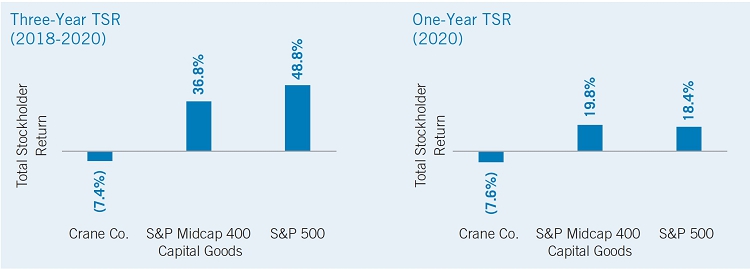

TSR Lagged Benchmarks Given End Market Headwinds

Despite this strong operational performance, total stockholder return (share price appreciation plus reinvested dividends) (TSR) trailed that of the consistent focusmost relevant benchmark indices on a one- and three-year basis. We believe that underperformance is primarily attributable to our exposure to two end markets that were among the most negatively impacted by the COVID-19 pandemic, and for which investors had substantial concerns about the short- and medium-term outlook: commercial aerospace, and the process industries which include oil & gas.

Crane Co. TSR for Periods Ending December 31, 2020

| 2021 Proxy Statement | 7 |

Proxy Summary

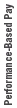

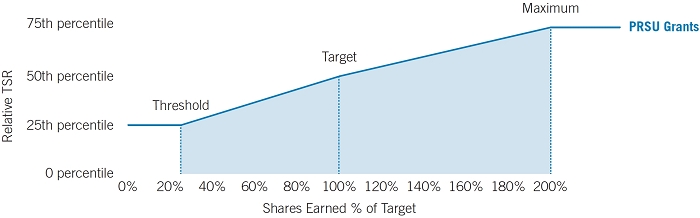

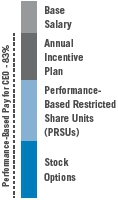

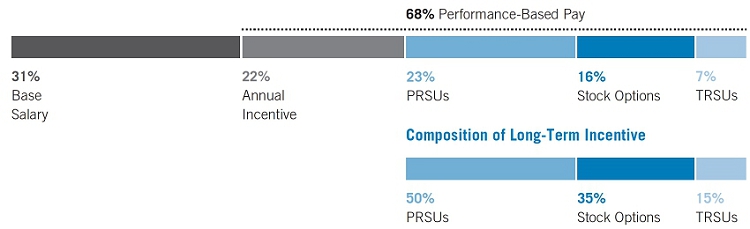

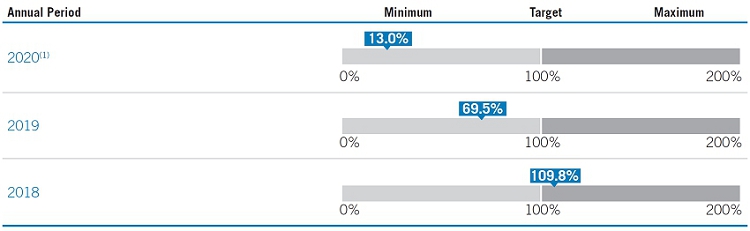

Consistent with the Management Organization and Compensation Committee (the “Compensation Committee”)Committee’s continued focus on aligning pay with performance, and despite the extraordinary circumstances in 2020, all variable elements of management’s compensation increaseddeclined compared to 2019, reflecting the business performance shortfalls relative to target, and lower three-year relative TSR compared to the prior year. Further, the performance-based restricted share units (PRSUs) granted to our named executive officers (NEOs) for the three-year period 2018-2020 vested at 0% due to below performance threshold resulting in 0 shares payout for 2020, reflecting the negative TSR for that period. PRSUs represent 41% of target pay for our CEO and, 23% of target pay, on average, for our other NEOs. In addition, reflecting the impact that the year’s financial performance had on both stockholders and other stakeholders, including Crane associates, our executive officers, including our NEOs, voluntarily took a temporary reduction in base pay from April through December (20% for the CEO and 10% for all other executive officers).

Crane Co. 2017 TSR Better than Benchmark Indices

Continued to Execute on Near-Term Priorities in 2017

In 2017, the Company delivered strong financial results in line with our operating plan objectives. Specifically:

6 Crane Co.

Proxy Summary

|  |  |

| |

|

20172020 Compensation Highlights

Compensation Best Practices

The Management Organization and Compensation Committee is firmly committed to implementing aan executive compensation program that aligns management and stockholder interests, encourages executives to drive sustainable stockholder value creation, and helps retain key personnel. Moreover, despite the global disruptions and adverse impact to the Company’s business caused by the ongoing pandemic, we remained committed to maintaining our core compensation plan design. Key elements of our pay practices are as follows:

WHAT WE DO |  WHAT WE DON’T DO WHAT WE DON’T DO | |||

• Pay for performance, aligning executive pay with Company results and stockholder returns | • Require significant stock ownership by executives, including a 6x base salary requirement for the CEO • Majority of executive variable pay is delivered in long-term equity-based awards • Appropriate mix of fixed and variable pay to balance employee retention with Company goals, both annual and long-term | |||

• Incentive compensation subject to clawback | ||||

• Management Organization and Compensation Committee retains independent compensation consultant |

• No excise tax gross-ups upon change in control | • No multi-year guaranteed incentive awards • No fixed-duration employment contracts with executive officers • No hedging or pledging of Company stock permitted • No excessive perquisites for executives | ||

• No | |||

• No repricing of options | |||

• No discounted stock options |

2018 Proxy Statement 7

| 8 | Crane Co. |

Proxy Summary

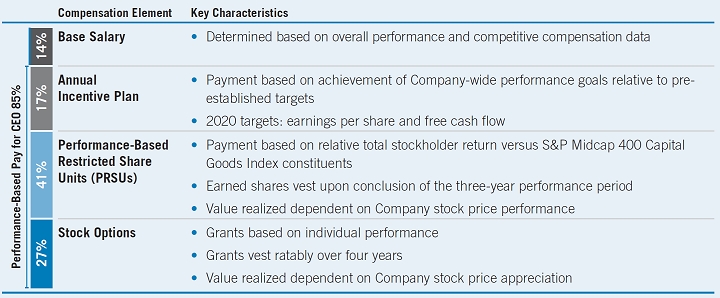

Pay andfor Performance Alignment

Over 80%

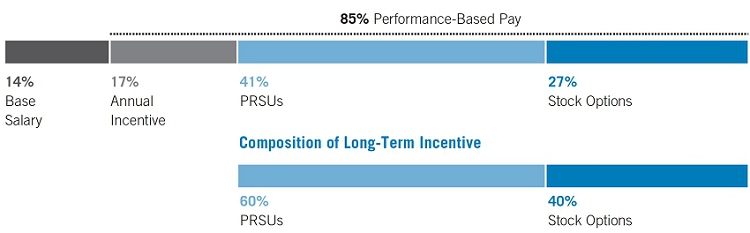

85% of CEO Target Pay is Performance-Based

The following table summarizes the major elements of our CEO compensation program.program, which is designed to link pay and performance.

Totals may not sum due to rounding.

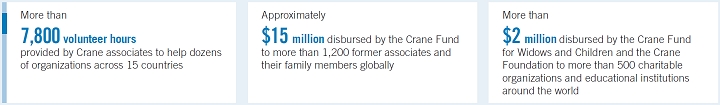

Our Philanthropy, Sustainability and Equality Highlights

Philanthropy

Sustainability

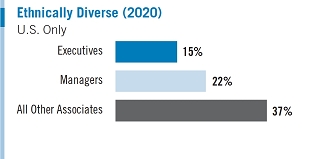

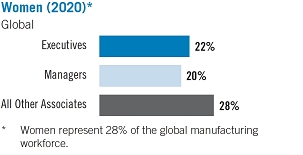

Equality

|  | |

See additional details on the Company’s efforts and performance with respect to philanthropy, sustainability, and equality, at www.craneco.com/pse. | ||

| 2021 Proxy Statement |  | |

| ||

| ||

|

8 Crane Co.

| Proxy Statement | ||

Proxy Statement

2018 Proxy Statement 9

| 10 | Crane Co. |

| Item 1: Election of Directors | ||

| PROPOSAL 1 The Board recommends votingFOReach of theDirector Nominees |  |

Crane Co. Board of DirectorsComposition

Our Corporate Governance Guidelines provide that the Board should generally have from nine to twelve directors, a substantial majority of whom must qualify as independent directors under the listing standards of the NYSE.New York Stock Exchange (“NYSE”).

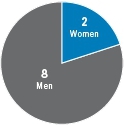

The Board of Directors currently consists of 12ten members, 11nine of whom are independent.

Prior to the 2017 annual meeting of stockholders, On December 8, 2020, the Board of Directors was divided into three classes with staggered three year terms. At the 2017 annual meeting, stockholders voted to declassifyincrease the size of the Board from a total of Directorsnine directors to ten and provide forto appoint John S. Stroup to fill that newly created interim vacancy. Mr. Stroup was also appointed to serve as a member of the annual election of directors, without reducing the term of any then incumbent director. There are sevenManagement Organization and Compensation Committee.

The ten directors whose terms will expire at the time of the Annual Meeting, but will serve until their successors are duly elected and four directors whose terms will expire at the annual meeting of stockholders in 2019.

The seven directors whose terms will expire at the time of the Annual Meetingqualified, are Martin R. Benante, Donald G. Cook, R.S. Evans,Michael Dinkins, Ronald C. Lindsay, Philip R. Lochner, Jr.,Ellen McClain, Charles G. McClure, Jr. and, Max H. Mitchell.Mitchell, Jennifer M. Pollino, John S. Stroup, and James L. L. Tullis. The Board of Directors has nominated each of them for re-election by the stockholders for a one yearone-year term to expire at the 20192022 annual meeting of stockholders. The Board of Directors has determined that all directors other than Mr. Mitchell are independent directors.

E. Thayer Bigelow, who has been a member of the Board since 1984, has reached the mandatory retirement age under our Corporate Governance Guidelines and will retire from the Board as of the time of the Annual Meeting.

Peter Scannell, who has been a member of the Board since 2015 and whose term would expire in 2019, has informed the Corporate Secretary that he intends to retire from the Board as of the time of the Annual Meeting.

The three remainingCompany believes a board with between nine to twelve directors Ellen McClain, Jennifer M. Pollinois appropriate to generate a manageable diversity of thought, perspective and James L. L. Tullis, who are not standing for election at the Annual Meeting, will continue to serve for the remainder of the terms for which they were elected, which will expire at the 2019 annual meeting of stockholders, and until their successors are duly elected and qualified.insight in a cost-efficient manner.

Director Nominating Procedures

The Board believes that a company’s directors should possess and demonstrate, individually and as a group, an effective and diverse combination of skills and experience to guide the management and direction of the Company’s business and affairs.affairs and to align with our long-term strategic vision. The Board has charged the Nominating and Governance Committee with responsibility for evaluating the mix of skills, experience and experiencediversity of background of the Company’s directors and director nominees, as well as leading the evaluation process for the Board and its committees.

Criteria for Board membership take into account skills, expertise, integrity, diversity, and other qualities which are expected to enhance the Board’s ability to manage and direct Crane Co.’s business and affairs. In general, nominees for director should have an understanding of the workings of large business organizations such as Crane Co., and senior level executive experience as well asleadership experience. In addition, nominees should have the ability to make independent, analytical judgments, the ability toand they should be an effective communicator andcommunicators with the ability and willingness to devote the time and effort required to be an effective and contributing member of the Board.

A director who serves as a chief executive officer shouldmay not serve on more than two public company boards in addition to our Board, and other directors should not sit on more than four public company boards in addition to our Board. The members of the Audit Committee shouldmay not serve on more than two other audit committees of public companies. All of the director nominees are in compliance with these requirements.

10 Crane Co.

Item 1: Election of Directors

The Nominating and Governance Committee has proposed, and the Board of Directors recommends, that each of the seventen nominees be elected to the Board. If, before the meeting, any nominee becomes unavailable for election as a director, the persons named in the enclosed form of proxy will vote for whichever nominee, if any,elected directors may make an interim vacancy appointment to the Board of Directors recommends to fillafter the vacancy,Annual Meeting, or the Board of Directors may reduce the number of directors to eliminate the vacancy.

| 2021 Proxy Statement | 11 |

Item 1: Election of Directors

Board Composition

Our Board takes an active and thoughtful approach to board composition and is focused on building and maintaining a diverse board. In conducting its annual review of director skills and Board composition, the Nominating and Governance Committee determined and reported to the Board its judgment that the Board as a whole demonstrates a diversity of organizational experience,and professional experience, education, and other background, viewpoint, skills, and other personal qualities and attributes that enables the Board to perform its duties in a highly effective manner. The NominatingCompany is proud to have such a diverse Board, including with respect to gender and Governance Committee also considers the Board’s overall diversity of experience, education, background, skillsethnicity.

Board Snapshot

Board Skills and attributes when identifying and evaluating potential director nominees.Experience

Board Snapshot

|  |  |

Our individual Board members have a wide range of skills and experience from within and outside our industry, giving them diverse perspectives from which to oversee the Company’s strategy of manufacturing a diverse range of highly engineered industrial products in markets where we have competitive differentiation and scale, and growing the business globally organically and through domestic and international acquisitions. Our Board members possess expertise in, among other things, acquisitions and other business combinations, diversified industrial operations and manufacturing, international business, corporate finance, human capital management, and organizational leadership.

2018 Proxy Statement 11

Summary of Board Skills and Experience

|  |  |  |  |  |  |  |  |  | |

| Public company multinational CEO experience | ● | ● | ● | ● | ● | |||||

| Public company multinational CFO experience | ● | |||||||||

| General finance acumen | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Corporate governance/board experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Mergers & acquisitions | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Manufacturing operations | ● | ● | ● | ● | ● | ● | ● | |||

| Expertise with one or more of Crane Co.’s end markets | ● | ● | ● | ● | ● | ● | ||||

| Intellectual capital development (human capital) | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Independent |  |  |  |  |  |  |  |  |  | |

| Self-Identified Race/Ethnicity | ||||||||||

| African American | ● | ● | ||||||||

| White Caucasian | ● | ● | ● | ● | ● | ● | ● | ● | ||

| Self-Identified Gender | ||||||||||

| Male | ● | ● | ● | ● | ● | ● | ● | ● | ||

| Female | ● | ● |

The Board Composition and Board Skills and Experience sections above reflect the Board’s current ten director nominees.

| 12 | Crane Co. |

Item 1: Election of Directors

Board of Directors Nominees and Continuing Directors

Nominees to be Elected for Terms to Expire in 20192022

| ||||

| MARTIN R. BENANTE | |||

Age: 68 Director Since:2015 | Crane Co. Committees:Audit Nominating & Governance | |||

Retired Chairman of the Board and Chief Executive Officer of Curtiss-Wright Corporation, Charlotte, NC (supplier of highly engineered products and services to commercial, industrial, defense, and energy markets), having served from 2000 to | ||||

2015. Other Directorships: • | ||||

Relevant Skills and Experience: • • • Expertise in domestic and international mergers and acquisitions, and in the global integration of acquired companies | ||||

| ||||

| DONALD G. COOK | |||

Age: 74 Director Since:2005 | Crane Co. Committees:Nominating and Governance (Chair); Management Organization and | |||

General, United States Air Force (Retired); consultant; independent | ||||

director since 2005. Other Directorships: • Texas Pacific Land Corporation since December 2020

• USAA Federal Savings Bank • | ||||

Relevant Skills and Experience: • • | ||||

12 Crane Co.

Note: Age calculations for all directors are as of the Record Date.

| 2021 Proxy Statement | 13 |

Item 1: Election of Directors

| ||||

| MICHAEL DINKINS | |||

Age: 66 2019Director Since: | Crane Co. Committees: | |||

Retired Executive Vice President and Chief Other Directorships: • The Shyft Group since 2020 • Community Health Systems, Inc. since 2017 • National Council on Compensation Insurance, Inc. since 2015 | ||||

Relevant Skills and Experience: • Sophisticated financial expertise acquired through public company chief financial officer, chief executive officer and financial, IT and internal audit roles

• CEO of a publicly traded company with international operations • Expertise in the • National Association of | ||||

| ||||

| RONALD C. LINDSAY | |||

Age: 62 Director Since:2013 | Crane Co. Committees:Audit; Management Organization and Compensation | |||

Retired Chief Operating Officer of Eastman Chemical Company, Kingsport, TN (manufacturer of specialty chemicals, plastics, and fibers). Chief Operating Officer from 2013 to 2016, and Executive Vice President, Specialty Fluids and Intermediates, Fibers, Adhesives and Plasticizers Worldwide Engineering, Construction and Manufacturing Support, | ||||

Relevant Skills and Experience: • | ||||

2018 Proxy Statement 13

| 14 | Crane Co. |

Item 1: Election of Directors

| ||||

| ELLEN McCLAIN | |||

Age: 56 2013Director Since: | Crane Co. Committees:Audit; | |||

Chief Financial Officer, Year Up, Boston, MA (not-for-profit provider of | ||||

Relevant Skills and Experience: • • Broad experience as a senior executive | ||||

| ||||

| CHARLES G. McCLURE, JR. | |||

Age: 67 Director Since:2017 | Crane Co. Committees: | |||

Managing Partner of Michigan Capital Advisors, Bloomfield, MI (private equity firm investing in Tier 2 and 3 global automotive and transportation suppliers). Prior to co-founding Michigan Capital Advisors in 2014, served from 2004 to 2013 as Chairman of the Board, CEO and President of Meritor, Inc., | ||||

markets). Other Directorships: • • • | ||||

Relevant Skills and Experience: • • | ||||

14 Crane Co.

| 2021 Proxy Statement | 15 |

Item 1: Election of Directors

| ||||

| MAX H. MITCHELL | |||

Age: 57 Director Since:2014 | Crane Co. Committees:Executive | |||

President and Chief Executive Officer of the Company since | ||||

Other Directorships: • • | ||||

Relevant Skills and Experience: • • Demonstrated expertise developing and • • Broad international and domestic M&A expertise, including successful integration of acquired companies • Extensive experience leveraging the Company’s intellectual/human capital management process to drive a performance-based culture | ||||

Continuing Directors Whose Terms Expire in 2019

| ||||

2018 Proxy Statement 15

Item 1: Election of Directors

| JENNIFER M. POLLINO | |||

Age: 56 Director Since:2013 | Crane Co. Committees:Audit; Management Organization and Compensation | |||

Executive Coach and Consultant, JMPollino LLC, Charlotte, NC since 2012. Executive Vice President, Human Resources and Communications, Goodrich Corporation, Charlotte, NC (aerospace products manufacturer) from 2005 to 2012. Prior positions at Goodrich included President and General Manager of Goodrich Aerospace’s Aircraft Wheels & Brakes Division and of its Turbomachinery Products Division, and Vice President and General Manager of Goodrich Aerospace, Aircraft Seating Products. | ||||

Other Directorships: • Hubbell Incorporated since 2020

• Wesco Aircraft Holdings, Inc. | ||||

Relevant Skills and Experience: • • • | ||||

| Crane Co. |

Item 1: Election of Directors

| JOHN S. STROUP | |||

Age: 54 Director Since: 2020 | Crane Co. Committees: Management Organization and Compensation | |||

Executive Chairman of Belden, Inc. (global leader in signal transmission and security solutions) since 2020. Other Directorships: • Tenneco since 2020 • Rexnord Corporation since 2012 • Belden, Inc. since 2005 | ||||

Relevant Skills and Experience: • More than 30 years of experience in industrial manufacturing of highly engineered products and business strategy development • Proven leadership skills with over 15 years of experience as president, chief executive officer and director of a global leader in signal transmission and security solutions | ||||

| JAMES L. L. TULLIS | |||

Age: 73 Director Since:1998 | Crane Co. Committees: | |||

Chairman, | ||||

from 1988 to the present. Other Directorships: • ATEC, Inc. since 2018 electroCore, Inc. from 2018 to 2020

• Lord Abbett & Co. Mutual Funds since • | ||||

Relevant Skills and Experience: • • | ||||

Vote Required

VOTE REQUIRED Our By-laws provide that nominees for director and directors running for re-election to the Board without opposition must receive the affirmative vote of a majority of votes cast. Any director who fails to receive the required number of votes for re-election is required by Crane Co. policy to tender his or her written resignation to the Chairman of the Board for consideration by the Nominating and Governance Committee. |  |

Our By-laws provide that nominees for director and directors running for re-election to the Board without opposition must receive the affirmative vote of a majority of votes cast. Any director who fails to receive the required number of votes for re-election is required by Crane Co. policy to tender his or her written resignation to the Chairman of the Board for consideration by the Nominating and Governance Committee.

16 Crane Co.

| 2021 Proxy Statement | 17 |

Item 1: Election of Directors

Independent Status of Directors

Standards for Director Independence

No

The listing standards of the NYSE, as well as Crane Co.’s Corporate Governance Guidelines, require that a majority of the Board be comprised of independent directors. In order for a director qualifiesto qualify as independent, unless the Board must affirmatively determinesdetermine that the director has no material relationship with Crane Co. The Board has adopted the standards set forth below in order to assist the Nominating and Governance Committee and the Board itself in making determinations of director independence. Any of the following relationships would preclude a director from qualifying as an independent director:

| The director is or was an employee, or the director’s immediate family member is or was an executive officer, of Crane Co. other than as an interim Chairman or interim CEO, unless at least three years have passed since the end of such employment relationship. | |

| • | The director is an employee, or the director’s immediate family member is an executive officer, of an organization (other than a charitable organization) that in any of the last three completed fiscal years made payments to, or received payments from, Crane Co. for property or services, if the amount of such payments exceeded the greater of $1 million or 2% of the other organization’s consolidated gross revenues. |

| • | The director has received, or the director’s immediate family member has received, direct compensation from Crane Co., if the director is a member of the Audit Committee or the amount of such direct compensation received during any twelve-month period within the preceding three years has exceeded $120,000 per year, excluding (i) director and committee fees and pension and other forms of deferred compensation for prior services (so long as such compensation is not contingent in any way on continued service); (ii) compensation received as interim Chairman or CEO; or (iii) compensation received by an immediate family member for service as a non-executive employee of Crane Co. |

| • | The director is a current partner of or employed by, or the director’s immediate family member is a current partner of, or an employee who personally works on the audit of Crane Co. at, a firm that is the internal or external auditor of Crane Co., or the director was, or the director’s immediate family member was, within the last three years a partner or employee of such a firm and personally worked on the Crane Co. audit at that time. |

| • | The director is or was employed, or the director’s immediate family member is or was employed, as an executive officer of another organization, and any of Crane Co.’s present executive officers serves or served on that other organization’s compensation committee, unless at least three years have passed since the end of such service or the employment relationship. |

| • | The director is a member of a law firm, or a partner or executive officer of any investment banking firm, that has provided services to Crane Co., if the director is a member of the Audit Committee or the fees paid in any of the last three completed fiscal years or anticipated for the current fiscal year exceed the greater of $1 million or 2% of such firm’s consolidated gross revenues. |

The existence of any relationship of the type referred to above, but at a level lower than the thresholds referred to, does not, if entered into in the ordinary course of business, preclude a director from being independent. The Nominating and Governance Committee and the Board review all relevant facts and circumstances before concluding that a relationship is not material or that a director is independent. Specifically, the Committee’s evaluation process includes the review of (i) direct and indirect relationships between directors and the Company, (ii) a report of transactions with director affiliated entities, (iii) director responses to annual questionnaires, and (iv) Code of Business Conduct and Ethics compliance certifications. In addition, the Nominating and Governance Committee reviews and must approve all charitable contributions in excess of $10,000 made by the Company or its affiliatedthrough one of the following three independent charitable funds: Crane Fund, Crane Fund for Widows and Children, or Crane Foundation, to any organization for which a director or his or her spouse or other immediate family member serves as a trustee, director, or officer or in any similar capacity. There were no such contributions in 2017.2020.

Crane Co.’s Standards for Director Independence, along with its Corporate Governance Guidelines and Code of Business Conduct and Ethics, which appliesapply to Crane Co.’s directors and to all officers and other employees, including our chief executive officer, chief financial officerChief Executive Officer, Chief Financial Officer and controller,Controller, are available on our website atwww.craneco.com/governancewww.craneco.com/governance.Crane Co. intends to satisfy any disclosure requirements concerning amendments to, or waivers. See “Code of the Code of Ethics by posting such information at that website address.Business Conduct and Ethics” on page 26.

2018 Proxy Statement 17

| 18 | Crane Co. |

Item 1: Election of Directors

Independence of Directors

The Nominating and Governance Committee has reviewed whether any of the directors other than Mr. Mitchell, who is Chief Executive Officer of Crane Co., has any relationship that, in the opinion of the Committee, (i) is material (either directly or as a partner, stockholder, director, or officer of an organization that has a relationship with Crane Co.) and, as such, would be reasonably likely to interfere with the exercise by such person of independent judgment in carrying out the responsibilities of a director or (ii) would otherwise cause such person not to qualify as an “independent” director under the rules of the NYSE and, in the case of members of the Audit Committee and the Management Organization and Compensation Committee, the additional requirements under SectionSections 10A and 10C, respectively, of the Securities Exchange Act of 1934 and the associated rules. The Nominating and Governance Committee determined that, other than Mr. Mitchell, all of Crane Co.’s current directors and all persons who served as a director of Crane Co. at any time during 20172020 are independent in accordance with the foregoing standards, and the Board of Directors has reviewed and approved the determinations of the Nominating and Governance Committee.

In evaluating the independence of all directors, the Board considered all transactions in which the Company and any director had an interest, including all purchases and sales with other companies on which a director served on that company’s board. The Board determined in each case that such purchases and sales were de minimis, comprising less than 0.15% of the Company’s revenues. The Board evaluated these transactions that arose in the ordinary course of business and on the same terms and conditions available to other customers and suppliers. Furthermore, in reaching their determinations regarding the independence of the other directors (other than Mr. Mitchell), the Committee and the Board applied the Standards for Director Independence described above and determined that there were no transactions that were likely to affect the independence of any director’s judgment.

Board RenewalRefreshment

At the 2017 annual meeting, our stockholders voted to declassify the Board of Directors, reducing the term of office for directors from three years to one year. In connection with this change, the Corporate Governance Guidelines were amended to increase the retirement age for directors from 72 to 75. Each director who has attained the age of 75 as of the record date for an annual meeting of stockholders or who has served on the Board for 15 years, is required to tender his or her resignation from the Board. The Corporate Governance Guidelines also require a director to tender his or her resignation from the Board if there is a significant change in his or her primary job responsibilities.responsibilities that could impact the skills or perspectives they bring to the Board. The Nominating and Governance Committee then makes a recommendation to the Board, based on a review of all the circumstances, whether the Board should accept the resignation or ask the director to continue on the Board.

The Nominating and Governance Committee will, from time to time, seek to identify potential candidates for director to sustain and enhance the composition of the Board with thean appropriate balance of knowledge, experience, skills, expertise, and diversity.diversity of thought to enable Crane Co. to formulate and implement its strategic plan. In this process, the Committee will consider potential candidates proposed by other members of the Board, by management, or by stockholders, and the Committee has the sole authority to retain a search firm to assist in this process, at Crane Co.’s expense.

Once a person has been identified by the Nominating and Governance Committee as a potential candidate, the Committee, as an initial matter, may collect and review publicly available information regarding the person to assess whether the person should be considered further. Generally, if the person expresses a willingness to be considered and to serve on the Board, and the Committee believes that the person has the potential to be a good candidate, the Committee would seek to gather information from or about the person, review the person’s accomplishments and qualifications in light of any other candidates that the Committee might be considering, and, as appropriate, conduct one or more interviews with the person. In certain instances, Committee members may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s background, skills and accomplishments. The Committee’s evaluation process does not vary based on whether or not a prospective candidate is recommended by a stockholder, although, as stated below, the Board may take into consideration the number of shares held by the recommending stockholder and the length of time that such shares have been held.stockholder.

18 Crane Co.

| 2021 Proxy Statement | 19 |

Item 1: Election of Directors

Board Effectiveness

Our Board of Directors, led by our Nominating and Governance Committee, evaluates the size and composition of our Board of Directors at least annually, giving consideration to evolving skills, diversity, perspective, and experience needed on our Board of Directors to perform its governance and oversight role as the business grows and evolves and the underlying risks change over time. Below are steps our Board has recently taken to proactively improve our Board effectiveness.

Nominations by Stockholders

In considering candidates submitted by stockholders, the Nominating and Governance Committee will take into consideration the needs of the Board and the qualifications of the candidate. A stockholder proposing to nominate a director must provide the followingcertain information about the nominating stockholder and the director nominee, including the following information and must update such information as of the record date for the meeting:

| the number of shares of Company stock, including details regarding any derivative securities, held by the nominating stockholder and the director nominee and any of their respective affiliates or associates; | |

| • | a description of any agreement regarding how the director nominee would vote, if elected, on a particular matter, including a representation that there are no other |

| • | a description of any agreement with respect to compensation as a director from any person other than Crane Co., including a representation that there are no other |

| • | a representation that the director nominee will comply with all publicly disclosed Board policies, including those relating to confidentiality; |

| • | a completed questionnaire similar to the one required of existing directors, a copy of which the Corporate Secretary will provide upon request; |

| • | a description of any material interest the nominating stockholder has in any such nomination; and |

| • | any other information about the proposed candidate that would, under the Securities and Exchange Commission’s proxy rules, be required to be included in our proxy statement if the person were a nominee. |

| 20 | Crane Co. |

Item 1: Election of Directors

Such notice must also be accompanied by a written consent of each proposed nominee to being named as a nominee and to serve as a director, if elected. A complete description of the requirements relating to a stockholder nomination is set forth in our By-laws.

Any stockholder recommendation for next year’s Annual Meeting,annual general meeting, together with the information described above, must be sent to the Corporate Secretary at 100 First Stamford Place, Stamford, CT 06902 and, in order to allow for timely consideration, must be received by the Corporate Secretary no earliernot less than December 24, 2018, and no later90 days nor more than January 23, 2019.120 days prior to April 26, 2022.

Majority Voting for Directors and Resignation Policy

Our By-laws provide that nominees for director and directors running for re-election to the Board without opposition must receive a majority of votes cast. Any director who fails to receive the required number of votes for re-election is required by Crane Co. policy to tender his or her written resignation to the Chairman of the Board for consideration by the Nominating and Governance Committee. The Committee will consider such tendered resignation and make a recommendation to the Board concerning the acceptance or rejection of the resignation. In determining its recommendation to the Board, the Committee will consider all factors deemed relevant by the members of the Committee including, without limitation, the stated reason or reasons why stockholders voted against such director’s re-election, the qualifications of the director, and whether the director’s resignation from the Board would be in the best interests of the Company and its stockholders.

2018 Proxy Statement 19

Item 1: Election of Directors

Board’s Role and Responsibilities

The Board is responsible for, and is committed to, overseeing the business and affairs of the Company and providing guidance for sound decision making, accountability and accountability.ethical professional conduct. It reviews the performance of our management and establishes guidelines and performance targets for our executive compensation program. The Board has adopted a comprehensive set of Corporate Governance Guidelines that set forth the Company’s governance philosophy, policies, and practices, and provide a framework for the conduct of the Board’s business.

Strategic Oversight

Our Board takes an active role in overseeing management’s formulation and implementation of its strategic plan. It receives a comprehensive overview of management’s strategic plan for all of the Company’s businesses at least annually, receives regular updates from consultants and other experts on the global capital markets and industrial environment, and receives periodic updates from individual businesses at other regularly scheduled Board meetings throughout the year. The Board provides insight and feedback to senior management, and, if necessary, challenges management on the Company’s strategic direction. The Board also monitors and evaluates, with the assistance of the Chief Executive Officer, the Company’s strategic results, and approves all significantmaterial capital allocation decisions.

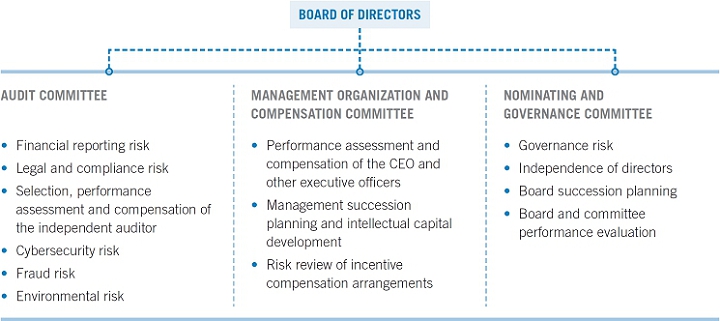

Risk Oversight

The Board recognizes its duty to assure itself that the Company has effective procedures for assessing and managing risks to the Company’s operations, financial position, and reputation, including compliance with applicable laws and regulations. The Board has charged the Audit Committee with responsibility for monitoring the Company’s processes and procedures for risk assessment, risk management, and compliance, includingwhich includes receiving regular reports on environmental remediation activities, and on any violations of law or Company policies and consequentresultant corrective action. The Audit Committee receives presentations regarding these matters from management at each in-person meeting (at least quarterly). The Company’s Director of Compliance and Ethics, as well as the Chief Audit Executive, has regular independent communications with the Audit Committee. The Chair of the Audit Committee reports any significant matters to the Board as part of his reports on the Committee’s meetings and activities.

| 2021 Proxy Statement | 21 |

Item 1: Election of Directors

The Board receives an annual presentation by management on the Company’s risk management practices. The Board also receives reports from management at each meeting regarding operating results, the Company’s asbestos liability, pending and proposed acquisition and divestiture transactions (each of which must be approved by the Board before completion), capital expenditures (material capital expenditures require Board approval), and other matters.

In addition, the Management Organization and Compensation Committee of the Board has established a process for assessing the potential that the Company’s compensation plans and practices may encourage executives to take risks that are reasonably likely to have a material adverse effect on the Company. The conclusions of this assessment are set forth in the Compensation Discussion and Analysis section under the heading “Compensation Risk Assessment” on page 47.55.

20 Crane Co.

Item 1: Election of Directors

Coordination Among Board Committees Regarding Risk Oversight

Management Succession Planning and Intellectual Capital

We have a comprehensive Intellectual Capital (“IC”) process at Crane Co. that encompasses careful and rigorous talent selection, systematic training and personalized development, and an annual assessment of performance and potential. Our Board of Directors and the Management Organization and Compensation Committee take an important role in our human capital management and the IC process. The Management Organization and Compensation Committee has the primary responsibilities for (i) assuring that the Company’s management development and succession planning policies and procedures are sound and effective, (ii) evaluating the performance of the Chief Executive Officer and other members of senior management, and (iii) regularly reporting its findings and recommendations to the Board of Directors. A key element of the IC process is the identification of management succession needs and opportunities, whether arising from natural career growth and development, voluntary turnover, retirements, or other causes. Such management succession planning forms part of our annual strategy review process for each of our businesses, and the senior management levels are reviewed with the Board annually. The Board’s oversight and involvement in the annual review of senior management level succession needs and opportunities promotes the identification and development of a pipeline of strong performance-focused senior leaders that possess diverse skills and talents.

Stockholder Engagement

The Company regularly meets with current and potential stockholders, both to provide transparency about its operations and results, and to better understand the investment community’s perception of the Company’s performance and corporate strategy. During 2017, the Company attended meetings with more than 100 different investors at conferences, during investor roadshows, and at industry events. Crane Co. also typically hosts an annual halfinvestor day investor event in New York City during the first quarter of the year to provide a thorough review of the prior year’s results, to discuss the Company’s outlook for the current year, and to review the Company’s corporate strategyportfolio and capital allocation policies.strategies. During 2020, the Company also participated in meetings, phone

| 22 | Crane Co. |

Item 1: Election of Directors

calls and video conference calls with approximately 120 different investors at conferences and during investor roadshows; in light of the global COVID-19 pandemic and related restrictions on travel and in-person gatherings, the substantial majority of these investor interactions during 2020 were virtual.

Our Vice President of Investor Relations and/or our Chief Financial Officer provide feedback from the investor and analyst meetings formally to the Board of Directors on a quarterly basis. Additional viewpoints and commentary from investors and analysts are incorporated into our comprehensive strategic review which is presented to the Board of Directors at least annually.

Stockholder Communications with Directors

The Board has established a process to receive communications from stockholders and other interested parties. Stockholders and other interested parties may contact any member (or all members) of the Board, any Board committee, or any Chair of any such committee by mail or electronically. To communicate with the Board of Directors, any individual director or any group or committee of directors, correspondence should be addressed to the Board of Directors or any individual director or group or committee of directors by either name or title. All such correspondence should be sent to Crane Co., c/o Corporate Secretary, 100 First Stamford Place, Stamford, CT 06902. To communicate with any of our directors electronically, stockholders should use the following e-mail address: adiorio@craneco.com.corpsec@craneco.com.

All communications received as set forth in the preceding paragraph will be opened by the office of the Corporate Secretary for the sole purpose of determining whether the contents representthey contain a message to our directors. Any contents will be forwarded promptly to the addressee unless they are in the nature of advertising or promotion of a product or service, or are patently offensive or irrelevant. To the extent that the communication involves a request for information, such as an inquiry about Crane Co. or stock-related matters, the Corporate Secretary’s office may handle the inquiry directly. In the case of communications to the Board or any group or committee of directors, the Corporate Secretary’s office will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the envelope or e-mailcommunication is addressed.

2018 Proxy Statement 21

Item 1: Election of Directors

Board Leadership Structure

Our Corporate Governance Guidelines do not require that the roles of Chairman of the Board and Chief Executive Officer be held by different individuals, as the Board believes that effective board leadership structure can be highly dependent on the experience, skills, and personal interaction between persons in leadership roles.roles and the needs of the Company at the time. These leadership roles are currently filled separately by our non-executivenon-employee Chairman of the Board, R.S. Evans,James L.L. Tullis, who possesses extensive experience with the Company and its operations, and by our Chief Executive Officer, Max H. Mitchell. To assist in defining this leadership structure, the Board adopted a position description for the role of the non-executivenon-employee Chairman of the Board, which is incorporated into our Corporate Governance Guidelines. The principal duties are as follows:

Provide leadership to the Board and ensure that each director is making an appropriate contribution; | |

| • | Guide the Board’s discharge of its duties, including reviewing corporate strategy, monitoring risk management and compliance activities, and evaluating senior management performance and succession planning; |

| • | Maintain an effective relationship with the Chief Executive Officer and act as a liaison between the Chief Executive Officer and the Board; |

| • | Chair meetings of the Board of Directors and the Annual |

| • | Organize and approve the agendas for Board meetings based on input from directors and the Chief Executive Officer; and |

| • | Conduct a performance evaluation of the Board. |

The Board believes thiswill continue to monitor and assess its leadership structure has affordedto ensure it best serves the needs of the Company an effective combinationand its stockholders.

| 2021 Proxy Statement | 23 |

Item 1: Election of Directors

Committees of the Board

The Board of Directors has established an Audit Committee, a Management Organization and Compensation Committee, and a Nominating and Governance Committee. The Board of Directors has also established an Executive Committee, which meets when a quorum of the full Board of Directors cannot be readily convened. The memberships of these committees during 2017 wereare as follows:

Audit Committee

Chair M. R. Benante Members M. Dinkins | Roles and Responsibilities The Audit Committee is the Board’s principal agent in fulfilling legal and fiduciary obligations with respect to matters involving Crane Co.’s accounting, auditing, financial reporting, internal control, and legal compliance functions. The Audit Committee has the authority and responsibility for the appointment, retention, compensation, and oversight of our independent auditors. Independence All members of the Audit Committee meet the independence and expertise requirements of the | |

22 Crane Co.

Item 1: Election of Directors

Management Organization and

Chair J. M. Pollino Members D. G. Cook | | Roles and Responsibilities The duties of the Management Organization and Compensation Committee include: coordinating the annual evaluation of the Chief Executive Officer; recommending to the Board of Directors all actions regarding compensation of the Chief Executive Officer; approving the compensation of other executive officers and reviewing the compensation of other officers and business unit presidents; reviewing director compensation; administering the annual incentive compensation plans and stock incentive plan; reviewing and approving any significant changes in or additions to compensation policies and Independence All members of the Management Organization and Compensation Committee meet the independence requirements of the |

| 24 | Crane Co. |

Item 1: Election of Directors

Nominating and Governance Committee

Chair D. G. Cook Members M. R. Benante |

Roles and Responsibilities The duties of the Nominating and Governance Committee include developing criteria for selection of and identifying potential candidates for service as directors, policies regarding tenure of service and retirement for members of the Board, Independence All members of the Nominating and Governance Committee meet the independence requirements of the |

Executive Committee

Chair J.L.L. Tullis Members D. G. Cook |

2018 Proxy Statement 23M. H. Mitchell

Item 1: Election of Directors

Roles and Responsibilities The Board of Directors has also established an Executive Committee, which meets when a quorum of the full Board of Directors cannot be readily convened. The Executive Committee may exercise any of the powers of the Board of Directors, except for approving an amendment of the Certificate of Incorporation or | ||

| 2021 Proxy Statement | 25 |

Item 1: Election of Directors

Executive Sessions of Non-Management Directors

Three

Eight of the meetings of the Board during 20172020 included executive sessions without management present, presided over by R. S. Evans,James L.L. Tullis, Chairman of the Board. Crane’s Corporate Governance Guidelines require our non-management directors to meet in executive session without management on a regularly scheduled basis, but not less than two times a year. The Chairman of the Board presides at executive sessions, unless he or she is a member of management, in which case the presiding person at executive sessions rotates on an annual basis among the Chairs of the Nominating and Governance Committee, the Audit Committee, and the Management Organization and Compensation Committee. If the designated person is not available to chair an executive session, then the non-management directors select a person to preside.

Board Meetings and Attendance

The Board of Directors met eightnine times during 2017.2020, including two special meetings. Each director attended over 80%100% of the Board and Committee meetings held in the period during which he or she was a director and Committee member. In addition, it is Crane Co.’s policy that each of our directors attend the Annual Meeting;our annual meetings either in person or telephonically; all members of the Board were present at the 20172020 annual meeting except Ms. Pollino, who was unable to attend due to illness.meeting.

Board and Committee Evaluation Process

Board and committee evaluations play a critical role in ensuring the effective functioning of the Board. It is essential to monitor the Board, committee, and individual director performance and consider and act upon the feedback provided by each Board member. The Nominating and Governance Committee, in consultation with the Chairman of the Board, is charged with overseeingfacilitating an annual self-assessment of the Board’s performance, as well as an annual self-assessment undertaken by each committee of the Board. The multi-stepmultistep evaluation process begins with a questionnaire, and includes one-on-one discussions with the Chairman and individual Board members, and one-on-one discussions withbetween Committee Chairs and the members of eachtheir respective committee. The results are provided to the full Board, and the Board’s policies and practices are updated as appropriate to reflect director feedback.

24 Crane Co.

Item 1: Election of Directors

Director Education

It is important for directors to stay current and informed on developments in corporate governance best practices in order to effectively discharge their duties. Our directors are provided updates on corporate governance developments at regularly scheduled board meetings receive a focused, in-house governance and compliance training session annually, and are encouraged to participate in programs offered by nationally recognized organizations that specialize in director education. The Company reimburses its directors for their reasonable costs and attendance fees to participate in such programs.

Code of Business Conduct and Ethics

Crane Co. is committed to conducting its business in compliance with all applicable laws, rules and regulations and in accordance with the highest standards of business ethics. Accordingly, the Directors, officers and all Company employees are required to act in accordance with Crane Co’s Code of Business Conduct and Ethics. Our Code of Business Conduct and Ethics covers many areas of professional ethical conduct, including the protection and proper use of Company assets, confidentiality, conflicts of interest, compliance with laws and fair dealing with competitors, employees and other Company stakeholders. A copy of the Code of Business Conduct and Ethics is available on our website at www.craneco.com/governance.

| 26 | Crane Co. |

Item 1: Election of Directors

Conflicts of Interest; Transactions with Related Persons

Crane Co. has established two Conflict of Interest Policies: CP-103, to which all officers and salaried employees are subject, and CP-103D, to which non-employee directorsDirectors are subject. Those who are subject to the policies are required to disclose to the General Counsel in writing each outside relationship, activity, and interest that creates a potential conflict of interest, including prior disclosure of transactions with third parties. The General Counsel will determine whether the matter does or does not constitute an impermissible conflict of interest, or may in his or her discretion refer the question to the Nominating and Governance Committee, which will review the facts and make a recommendation to the Board. All directors, executive officers, and other salaried employees are required to certify in writing each year whether they are personally in compliance with CP-103 or CP-103D, as applicable, and whether they have knowledge of any other person’s failure to comply. In addition, each director and executive officer is required to complete an annual questionnaire which calls for disclosure of any transactions above a stated amount in which the director or officer or any member of his or her family has a direct or indirect material interest. The Board of Directors is of the opinion that these procedures in the aggregate are sufficient to allow for the review, approval, or ratification of any “Transactions with Related Persons” that would be required to be disclosed under applicable Securities and Exchange Commission rules.

Company Policy Regarding Hedging Transactions

Crane Co.’s Policy on Trading in Company Stock prohibits members of the Board or Directors, executive officers, and certain other employees designated as “Employee Insiders” (generally, employees involved in compiling or having access to monthly operating forecasts or other Company-wide financial information) from engaging in any hedging transactions. The policy applies to any transaction that allows the individual to continue to own the covered securities, but without the full risks and rewards of ownership, such as zero-cost collars and forward sale contracts. The policy applies to any Company stock owned by the individual, whether acquired through equity compensation awards or otherwise.

Corporate Governance Documents

The Board of Directors has adopted Corporate Governance Guidelines which reflect the Board’s commitment to monitor the effectiveness of policy-making and decision-making at both at the Board and management level,levels, with a view to enhancing long-term stockholder value. The Corporate Governance Guidelines are available on our website atwww.craneco.com/investors/corporate-governancewww.craneco.com/GovernanceGuidelines.

Copies of the charters of the Board committees are available on our website atwww.craneco.com/CharterAudit; www.craneco.com/CharterAudit; www.craneco.com/CharterCompensation; and andwww.craneco.com/CharterNominating, respectively.

2018 Proxy Statement 25

| 2021 Proxy Statement | 27 |

Item 1: Election of Directors

Corporate Governance and Sustainability

We value global diversity, respect human rights and the rule of law, and recognize environmental management among our highest priorities throughout the corporation. In embracing this important topic, we have established a senior management committee and created a management position to identify and track metrics on philanthropy, sustainability and equality. This committee publishes a separate report on the Company’s efforts and performance with respect to philanthropy, sustainability, and equality, which can be found at www.craneco.com/pse. In addition to the details to be found in that report, following are examples of our actions and policies aimed at health and safety, philanthropy, diversity and inclusion, protecting the environment, governance and ethics, and supply chain management.

Health & Safety | • Strongly committed to the health and safety of our associates, and strive to continuously reduce the incidence and severity of job-related injuries • Utilize safe technologies, training programs, effective risk management practices, and sound science in our operations to minimize risk to our associates |

Philanthropy | • Embrace philanthropy around the world, providing paid time off to our associates from their work schedules to volunteer and support charitable causes important to our local teams • Annually facilitate the donation of more than $17 million through three independent charitable funds (the largest of which is also our largest shareholder), to former associates in need, to local organizations in the communities where our businesses operate, and in support of important global relief efforts |

Diversity & Inclusion | • Commitment to diversity on our Board of Directors, and across our global workforce, with a focus on developing an inclusive and high-performance culture with trust and respect • Focused development for our associates leveraging a structured intellectual capital process with constructive reviews and various talent/leadership development initiatives endorsed by the executive management team |

Protecting the Environment | • Comply with all applicable environmental laws governing the use, storage, discharge, and disposal of hazardous or toxic material • Seek to improve the operation of our facilities through the efficient use of energy and sustainable use of renewable resources, and commitment to waste reduction, recycling, reducing water usage and carbon emissions, and implementing responsible waste disposal practices |

Governance & Ethics | • Annual review of Corporate Governance Guidelines by the Board of Directors and outside experts • Code of Business Conduct and Ethics adopted by our Board of Directors, as well as anti-bribery policies, and policies prohibiting the Company from engaging in the political process (associates, however, are encouraged to participate in the political process privately if they wish, on their own time and using their own resources) • Mandatory annual training for associates on ethics and anti-bribery • Maintain an actively managed, anonymous ethics hotline |